Smarter Payment Processing for Retail & Specialty Merchants

A Modern Retail Payment Infrastructure That Works With Your Existing Systems

Our payment integration is designed specifically for retail and specialty merchants, providing a flexible payment processing layer that works alongside your existing POS, inventory, eCommerce, and accounting workflows.

Payments post automatically, reducing back-office workload and administrative friction—without disrupting your current operations or requiring a system overhaul.

The Current Problem in Retail Payments

Many retail and specialty businesses rely on payment processing bundled into POS platforms, eCommerce tools, or legacy merchant accounts. These systems are designed around vendor convenience, not real-world retail operations.

-Common issues include:

-Percentage-based card fees applied uniformly across all transactions

-Limited visibility into true processing costs

-Flat-rate pricing that penalizes higher-volume merchants

-Manual reconciliation between POS, online sales, and accounting systems

-Delayed funding and reporting inconsistencies

This is a structural inefficiency driven by how retail payments are delivered—not by poor internal processes.

Why Retail & Specialty Merchants Overpay on Processing

Retailers often pay more than necessary due to bundled payment structures:

• Processing embedded inside POS or eCommerce platforms

• Convenience pricing baked into checkout experiences

• Limited control over rate optimization or routing

• One-size-fits-all pricing models

• Manual reconciliation that adds hidden labor costs

The result is higher fees, tighter margins, and unnecessary administrative overhead.

Why Retail & Specialty Merchants Choose Our Integration

• Lower total processing costs

• Cleaner reconciliation across systems

• Faster access to funds

• Better visibility into payment data

• Flexible payment options for customers

• Scales with business growth

What is Our Solution: A Dedicated Payment Integration for Retail?

Our integration provides a payment processing layer designed specifically for service businesses—separating payments from rigid software pricing models while keeping workflows clean and aligned.

Core capabilities include:

• Transparent pricing models that reduce effective processing rates

• More efficient payment tracking within existing systems

• Credit card and ACH payment support

• Secure handling of customer payment data

• Control over how, when, and where customers pay

By improving payment visibility and reducing manual entry, the integration helps minimize errors and frees office staff to focus on dispatching, customer service, and growth—not reconciliation.

Common Use Cases

In-store checkout and mobile payments

Online and omnichannel sales

Buy-now-pay-later or structured payment options

Invoicing for specialty orders

Recurring or membership-based retail models

Integrated reporting across sales channels

Request a Payment Cost Review

If you want to understand what your business is paying in processing fees—and what manual payment handling is costing in staff time—we offer a straightforward payment cost review.

No operational disruption

No obligation

Clear comparison of current vs. optimized costs

Request a Payment Cost Review →

See What You’re Paying to Accept Client Payments

What Our Clients Are Saying...

The Highest Google Rated Payment Solutions Team in Tampa Bay

Contact Us

Call/Text : (727) 732-3292

Email: [email protected]

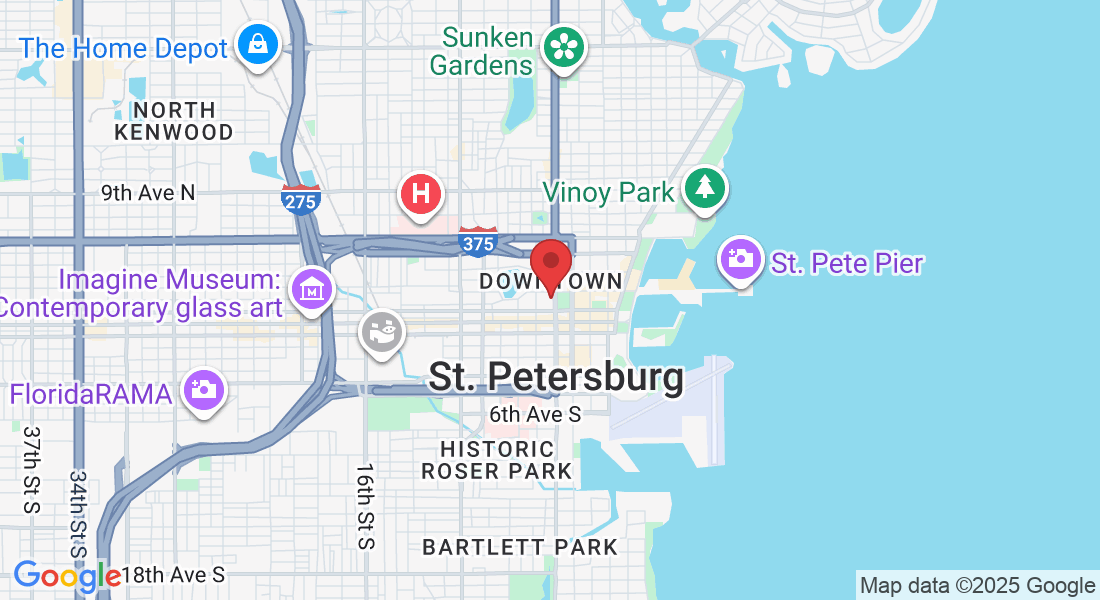

Address: 136 4th St N, Suite 223, St Petersburg, FL 33701

Hours: Mon-Friday 10:00 a.m. – 7:00 p.m.

* By Appointment Only *

Facebook

Instagram

LinkedIn