Compliant Payment Processing for Law Firms

Built for Law Services, Not Legal Software Margins

An External Invoicing & Payment Gateway That Works Alongside Your Existing Legal Systems

Most law firms already use modern practice management software. The issue is not billing or case management. The issue is how payments are routed, priced, and handled in compliance with trust account rules.

We provide a standalone invoicing and payment gateway that operates outside bundled legal software processors, allowing firms to:

- Accept client payments without percentage-based card fees

- Maintain full IOLTA trust compliance

-Keep their existing billing systems untouched

✅ No change to how you practice law

✅ No disruption to your workflows

✅ No co-mingling of funds

The Right Way to Accept Payments as a Law Firm

Most firms need two merchant accounts to stay compliant:

1. Operating Account

• For earned income: hourly billing, flat fees, etc.

• All processing fees are deducted here.

2. Trust Account (IOLTA)

• For unearned client funds like retainers or settlements.

• No fees can be deducted from this account.

We set you up with a payment system that ensures:

• Deposits go to the correct account

• Fees are withdrawn only from the operating account

• ABA & IOLTA compliance from day one

Our Solution: Independent Payment Infrastructure for Law Firms

Most firms need two merchant accounts to stay compliant:

1. Operating Account

- For earned income: hourly billing, flat fees, etc.

- All processing fees are deducted here.

2. Trust Account (IOLTA)

- For unearned client funds like retainers or settlements.

- No fees can be deducted from this account.

We set you up with a payment system that ensures:

- Deposits go to the correct account

- Fees are withdrawn only from the operating account

- ABA & IOLTA compliance from day one

The Right Way to Accept Payments as a Law Firm

We provide your firm with a compliant, cost-effective payment gateway that integrates seamlessly with your practice—but operates independently of your billing software

.

- Invoice clients using custom links

- Maintain trust and operating account separation

- Avoid flat-rate fees entirely

- Keep your current billing software

- Support for ACH, credit cards, and high-ticket invoices

Law Firm Types We Support

• Solo and Small Law Firms

• Personal Injury Attorneys

• Family and Domestic Law

• Criminal Defense Firms

• Estate Planning and Probate

• Business and Transactional Law

• Multi-State and Multi-Partner Firms

Common Use Cases

• Client invoice payments

• Retainer deposits & replenishments

• Online and remote client billing

• High-dollar invoices

• Custom payment plans

Why Law Firms Overpay on Processing

Law firms typically overpay because payment processing is treated as a feature of software rather than a controllable cost center.

Key structural reasons:

• Processing is bundled and non-negotiable

• Flat-rate pricing applies regardless of volume

• Convenience pricing is embedded in invoice payment links

• No alternative routing for client payments

• As collections grow, fees scale automatically

For firms with meaningful monthly receivables, this becomes a significant operating expense.

Why Firms Choose Tampa Bay Pay

• Compliant IOLTA trust routing

• Cleaner reconciliation and deposit tracking

• Integrates with Clio, PracticePanther, and more

• Transparent, negotiable pricing

• Better control over ACH and card fees

• Faster access to funds

• Support from a local, compliance-driven team

Request a Payment Cost Review

If your firm currently accepts payments through bundled legal software processors, a cost review can quantify what those fees are costing annually.

The review is straightforward:

No system changes

No obligation

Clear comparison between current processing costs and an optimized structure

Request a Payment Cost Review →

See What You’re Paying to Accept Client Payments

What Our Clients Are Saying...

The Highest Google Rated Payment Solutions Team in Tampa Bay

Contact Us

Call/Text : (727) 732-3292

Email: [email protected]

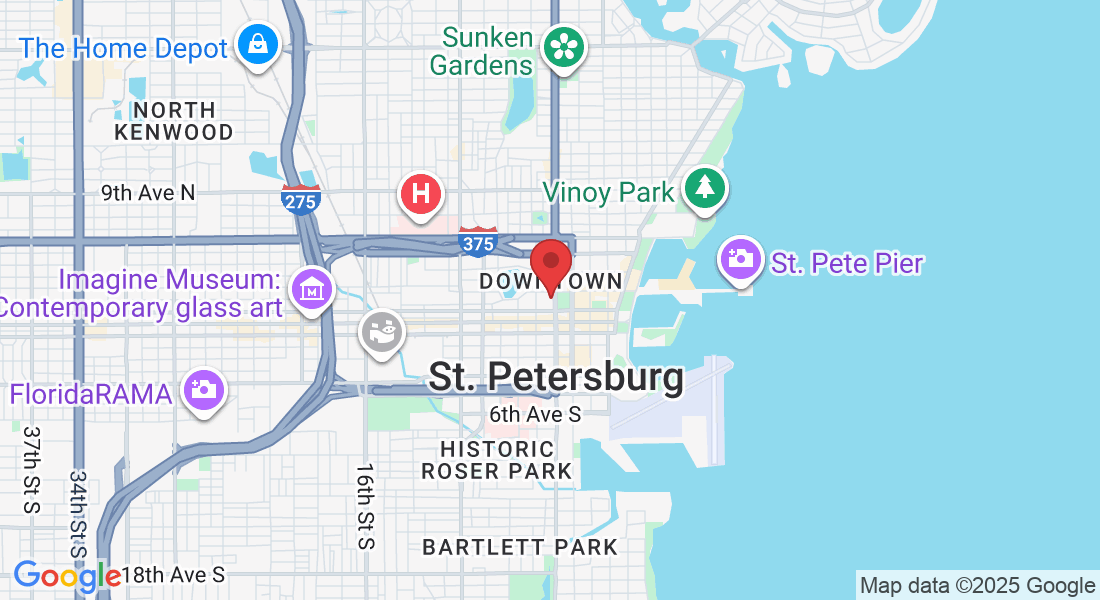

Address: 136 4th St N, Suite 223, St Petersburg, FL 33701

Hours: Mon-Friday 10:00 a.m. – 7:00 p.m.

* By Appointment Only *

Facebook

Instagram

LinkedIn