Payment Processing Pricing Options

At Tampa Bay Pay, we don’t believe in one-size-fits-all pricing. Every business is different—and so are their options. We’ll help you choose between low, transparent rates you absorb or a compliant model to offset fees partially or entirely.

Option 1: Absorb the Fee

Interchange-Plus Pricing: Transparent wholesale costs + small markup

Ideal for: B2B, invoicing, or businesses where absorbing the fee is a customer experience choice

Benefits: Transparent, scalable, usually lower than flat rate models

Option 2: Pass the Fee to the Customer

Compliant Dual Pricing, Cash Discounting, Compliant Surcharge and Convenience Fee Pricing Models

Ideal for: Retail, restaurants, contractors, and more

Benefits: Keep 100% of your sales, lower your costs, stay compliant

❓ What’s your lowest rate?

We get this question a lot—and the honest answer is: it depends. Rates vary based on your volume, industry, and risk profile. But here’s what we can promise:

We will always match or beat any competing offer—and we’ll show you exactly how.

Rates are negotiable based on your processing volume and history.

For a new, low-risk business that chooses to absorb the fees, we typically start at:

Interchange + 0.50% + $0.25 per transaction, with a monthly fee based on your setup (often between $0–$50/month, depending on what POS/software/service and/or amount of terminals and equipment)

That said, many clients opt for a compliant way to pass the fee to the customer—so they can keep 100% of their revenue and eliminate processing fees altogether. Either way, we’ll help you choose the setup that makes the most sense for your business.

❓ Can I pass the fee to the customer? Is that legal?

Yes—but only if it’s done the right way. We offer compliant Dual Pricing, Cash Discounting, Surcharging (for credit only), and Convenience Fee setups. Visa and Mastercard have specific rules, and we follow them to the letter. You won’t find any “grey area” setups here.

❓ How fast do I get my money?

Most clients receive their deposits the next business day. Need faster funding? We can often set up same-day funding depending on the processor and batch time.

❓ Do you charge monthly fees or equipment fees?

It depends on your setup. Some clients pay zero monthly fees. Others need software integrations, mobile solutions, or POS systems—so fees vary. We always go over this upfront. No surprise charges, ever.

❓ Is dual pricing or cash discounting the same as a surcharge?

Nope! They’re different. A surcharge adds a fee at checkout and can only be applied to credit cards. Dual pricing shows both a cash and card price upfront (like gas stations do). Both can be legal and compliant—if done right. We’ll guide you to the right one for your business.

❓ I’m using Square/Stripe now. Can you actually beat that?

Absolutely. Those “flat rates” can look simple, but they’re often expensive—especially for debit cards. With a traditional pricing model or a compliant fee-offset setup, we usually beat Square or Stripe by 20–50% or eliminate your costs altogether.

❓ What if I already have equipment or software?

No problem. We work with dozens of gateways, CRMs, POS systems, and mobile devices. In most cases, we can integrate with what you already use—or help you transition smoothly if you’re ready for an upgrade.

❓ Do I have to sign a long-term contract?

Nope. We don’t believe in locking people in. Most of our solutions are month-to-month with no cancellation fees. If we don’t earn your business every month, we don’t deserve it.

What our clients are saying...

The Highest Google Rated Payments Team in Town

Get In Touch

Call/Text : (727) 732-3292

Email: [email protected]

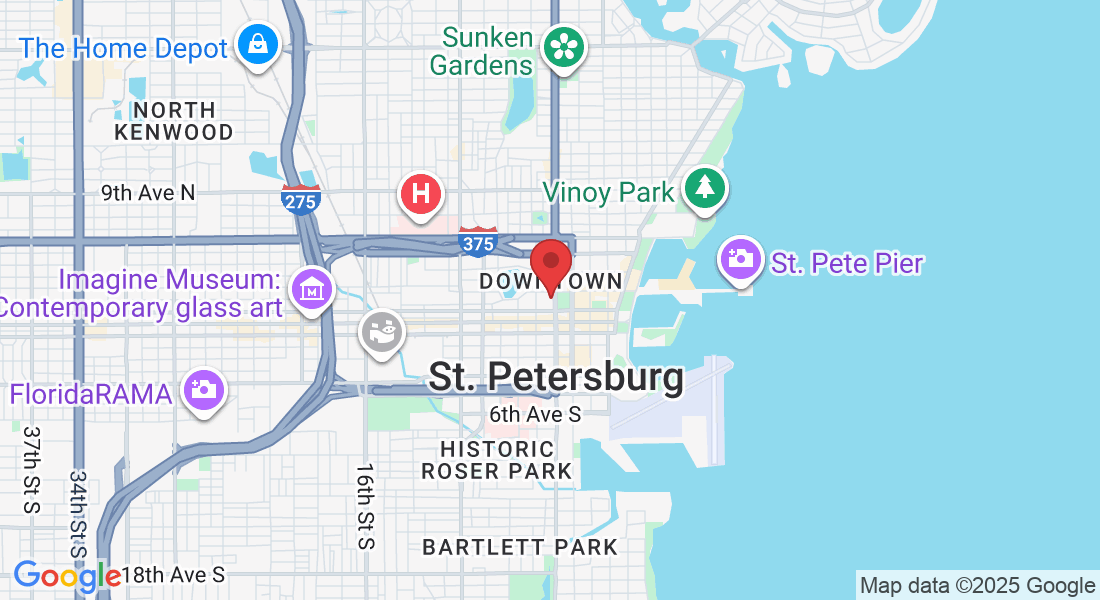

Address : 136 4th St N, Suite 223, St Petersburg, FL, 33701

Hours: Mon – Friday 10:00am - 7:00pm

* By Appointment Only *

Facebook

Instagram

LinkedIn