Flexible Payment Processing for Restaurants & Bars

A Modern Restaurant Payment Infrastructure That Works With Your Existing Systems

Our payment integration is built specifically for restaurants and bars, offering flexible payment processing through Figure and Clover that works seamlessly alongside your existing POS, online ordering, delivery platforms, and accounting workflows. Payments sync automatically, reducing staff workload and operational friction—without disrupting daily service or requiring a system change. Whether you’re processing payments in-store, online, or on the go, our solutions adapt to your operation instead of forcing you into a rigid system.

The Current Problem in Restaurant Payment Processing

Many restaurants rely on payment processing bundled into POS systems, online ordering platforms, or legacy merchant accounts. These setups are built for platform convenience—not for restaurant efficiency or margin protection.

Common issues include:

- Flat or percentage-based card fees applied to every transaction

-Limited visibility into actual processing costs

-Manual reconciliation across POS, delivery apps, and deposits

-Staff time spent troubleshooting payments instead of serving guests

-Separate systems for in-store, online, and delivery payments.

Restaurant & Bar Types We Support

Quick Service Restaurants (QSR)

Full-Service Restaurants

Bars, Lounges, and Nightclubs

Cafés and Coffee Shops

Food Trucks and Pop-Ups

Multi-Location Restaurant Groups

Common Use Cases

In-store POS payments

Online ordering and pickup

Delivery and third-party platform payments

Bar tabs and split checks

Catering and event invoices

Recurring billing for house accounts or memberships

Why Restaurants Overpay on Processing

Restaurants often pay more than necessary due to bundled and inflexible payment systems:

• Processing locked into POS or online ordering platforms

• Convenience fees built into delivery and payment tools

• No control over routing card vs. ACH transactions

• Flat-rate pricing that penalizes high-volume locations

• Hidden labor costs from manual reconciliation

The result: higher fees, tighter margins, and unnecessary administrative work.

Why Restaurants Choose Our Integration

• Lower total processing costs

• Simplified reporting across all payment channels

• Faster access to funds

• Reduced staff time spent on reconciliation

• English & Spanish support for smoother communication

• Flexible payment options for guests

• Scales easily as locations and volume grow

What is a Dedicated Restaurant Payment Integration?

Our solution provides a dedicated restaurant payment integration designed to simplify and optimize how you accept and manage payments. Core capabilities include:

• Transparent pricing models that reduce effective processing rates

• Automatic payment tracking and reporting

• Credit card and ACH payment support

• Secure, compliant handling of customer payment data

• Control over how and where payments are accepted

Request a Payment Cost Review

If you want to understand what your restaurant is paying in processing fees—and what payment handling is costing in staff time—we offer a straightforward payment cost review.

No operational disruption

No obligation

Clear comparison of current vs. optimized costs

Request a Payment Cost Review →

See What You’re Paying to Accept Client Payments

What Our Clients Are Saying...

The Highest Google Rated Payment Solutions Team in Tampa Bay

Contact Us

Call/Text : (727) 732-3292

Email: [email protected]

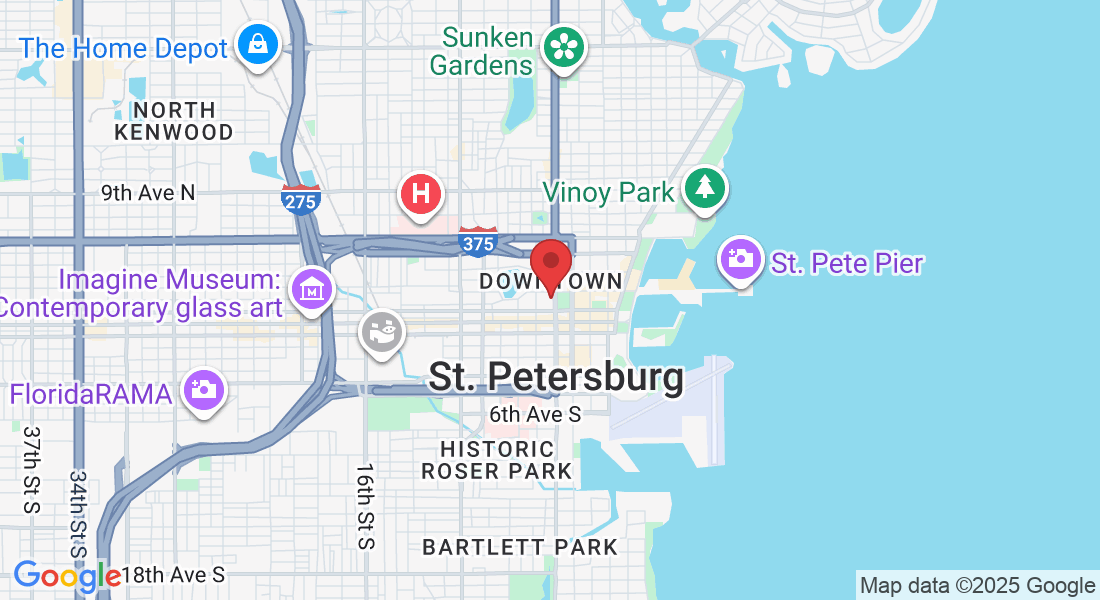

Address: 136 4th St N, Suite 223, St Petersburg, FL 33701

Hours: Mon-Friday 10:00 a.m. – 7:00 p.m.

* By Appointment Only *

Facebook

Instagram

LinkedIn