Payment Processing Solutions for Regulated & High-Risk Businesses

Stable, Compliant Payment Solutions Built for Complex Industries

Many regulated and high-risk businesses operate in industries where standard processors either decline accounts or impose restrictive terms. The issue is not the business model.

The issue is access to stable, compliant, and fairly priced payment processing.

We provide payment processing solutions designed specifically for regulated and high-risk industries, helping businesses accept payments reliably while staying compliant and operationally stable.

No disruption to daily operations.

No unnecessary account shutdowns.

The Current Problem in High-Risk Payment Processing

Regulated and high-risk businesses often face challenges when working with traditional payment processors. Common characteristics include:

-Sudden account holds or terminations

-Elevated processing fees with little explanation

-Limited transparency around risk controls

-Restricted payment methods

-Inconsistent support when issues arise

Regulated & High-Risk Industries We Support

• CBD, hemp, kratom, and supplements

• Cannabis-related businesses (where legal)

• Firearms, ammunition, and accessories

• Tobacco, vaping, and e-cigarettes

• Alcohol delivery services

• Adult content and entertainment

• Gambling, sports betting, fantasy sports

• Crypto, NFTs, and digital assets

• Bail bonds and legal funding

• Debt collection agencies

Common Use Cases

In-store and online payments

Subscription and recurring billing

High-ticket transactions

Remote and card-not-present payments

ACH and alternative payment methods

Why Regulated & High-Risk Businesses Overpay on Processing

High-risk businesses typically overpay because risk management is prioritized over operational efficiency

Key structural reasons:

• Limited processor availability reduces pricing leverage

• Higher fees applied across all transactions

• Conservative risk models that restrict volume or funding

• Limited flexibility in payment routing

• Few options for long-term processing stability

What is Our Solution: Specialized High-Risk Payment Processing?

We work with acquiring banks and processing partners that understand regulated and high-risk industries.

• Use POS systems that support inventory management

• Accept lower-cost debit and card payments

• Offer loyalty and rewards programs

• Use mobile and countertop terminals

• Maintain clean reporting and reconciliation

Request a Payment Cost Review

If your firm currently accepts payments through bundled legal software processors, a cost review can quantify what those fees are costing annually.

The review is straightforward:

No system changes

No obligation

Clear comparison between current processing costs and an optimized structure

Request a Payment Cost Review →

See What You’re Paying to Accept Client Payments

What Our Clients Are Saying...

The Highest Google Rated Payment Solutions Team in Tampa Bay

Contact Us

Call/Text : (727) 732-3292

Email: [email protected]

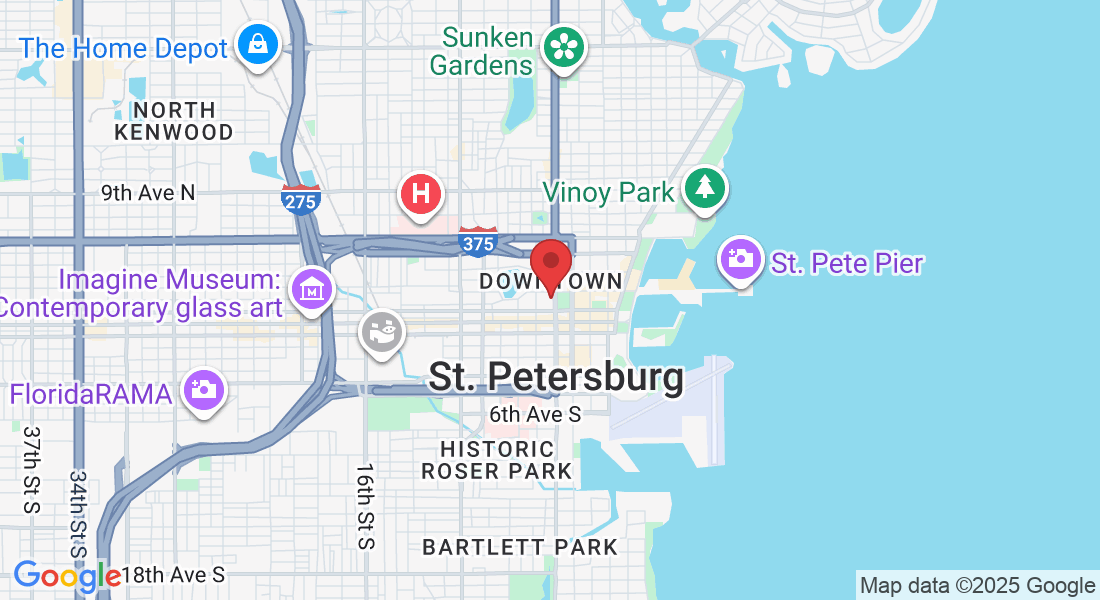

Address: 136 4th St N, Suite 223, St Petersburg, FL 33701

Hours: Mon-Friday 10:00 a.m. – 7:00 p.m.

* By Appointment Only *

Facebook

Instagram

LinkedIn